It has taken a couple of years, but the Australian and American share markets are now back trading at all-time highs.

Since 2020, markets have been bouncing around as the world has lurched from one crisis to the next. We had a precipitous drop when COVID hit, with share markets falling around 40% globally. The only thing more unexpected than the pandemic collapse was that it only took some markets 4 months to recover these losses. The speed of this recovery was unprecedented, especially given that at the time, most of the world was still in lockdown with global trade at a standstill.

In 2022, we then suffered our second bear market in three years. This one seemed insidious and more likely to have far-reaching effects. For the first time in 40 years, we were faced with rampant inflation and central banks had no choice but to embark on the quickest interest rate hikes in history. Share markets tumbled over 25% and bonds had their worst 12-month return since the 90’s. 15 months later, share markets are back trading at all-time highs. Bonds have also recovered a lot of their losses, delivering a good return in 2023.

Through all of this, there has never been a better advert for why it is so important to stay the course with investing, stick to your plan and ensure you have the necessary support to make smart decisions when you feel most under pressure. As time passes, it is easy to dismiss the anxiety and stress that we all felt during those tough times. However, the more we all experience the gyrations of markets, the more resilient we become, and the greater our confidence in being able to ride out the next round of volatility.

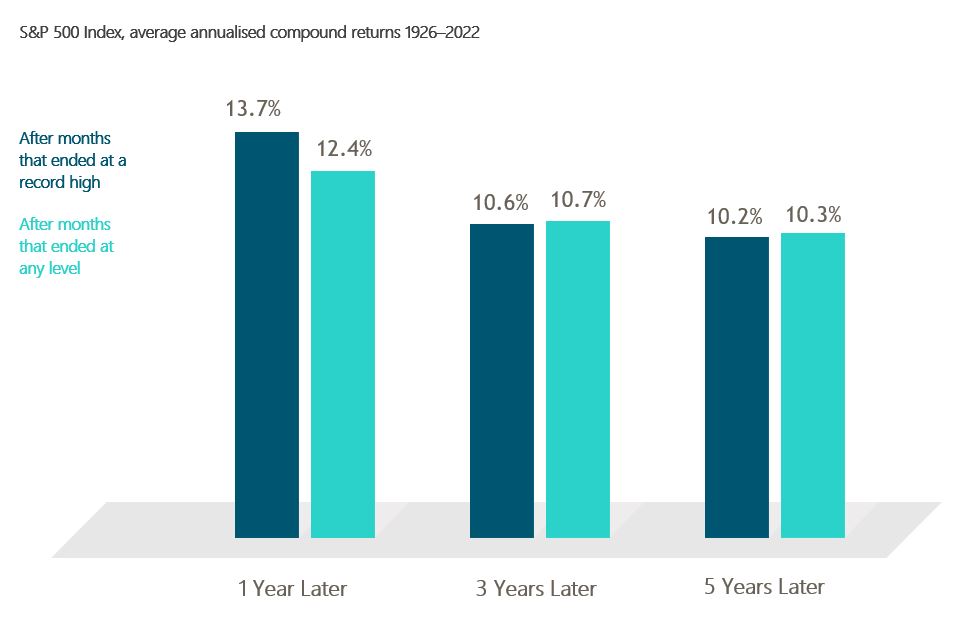

One of the happier challenges that we face when markets are trading at all-time highs, is a feeling that shares may be overvalued or expensive. It’s important to remember that over the longer term, shares have always delivered positive returns, so reaching new highs regularly is the outcome that we should expect. Interestingly, if we look back over the last 100 years of data on the monthly closing levels of the S&P 500 (USA share market), 30% of them were ‘new highs’. You may also be surprised to know that further analysis of this data shows that the average investment returns one, three and five years after a new month-end market high is similar to those after months that ended at any level.

So much in life and investing is outside of your control. However, you can take charge of how you prepare and react to news and curveballs. You can control how much you save or spend, the risk you take on, the plan you have in place, and the systems, processes and framework around which you make decisions. Once you come up with the road map for success – rally your supporters, turn down the volume on your detractors, and filter out all the noise the world throws at you.

This is the mindset that is key to becoming a successful long-term investor and living your best life.