The last recession in Australia was in 1990-1994, the famous ‘recession we had to have’, according to then federal treasurer, Paul Keating. Since then we have enjoyed over 25 years of economic sunshine.

There’s little doubt that the trade war between US and China is driving the slowdown. Motivated by the trade imbalance with China, President Trump is railing against the theft of intellectual property and China’s low-cost imports. The reason this trade war will impact both countries is that their economies are highly integrated. The very people President Trump seeks to protect are the very same small business owners who sell Chinese manufactured goods, or worse use them in the production of their own US-made products.

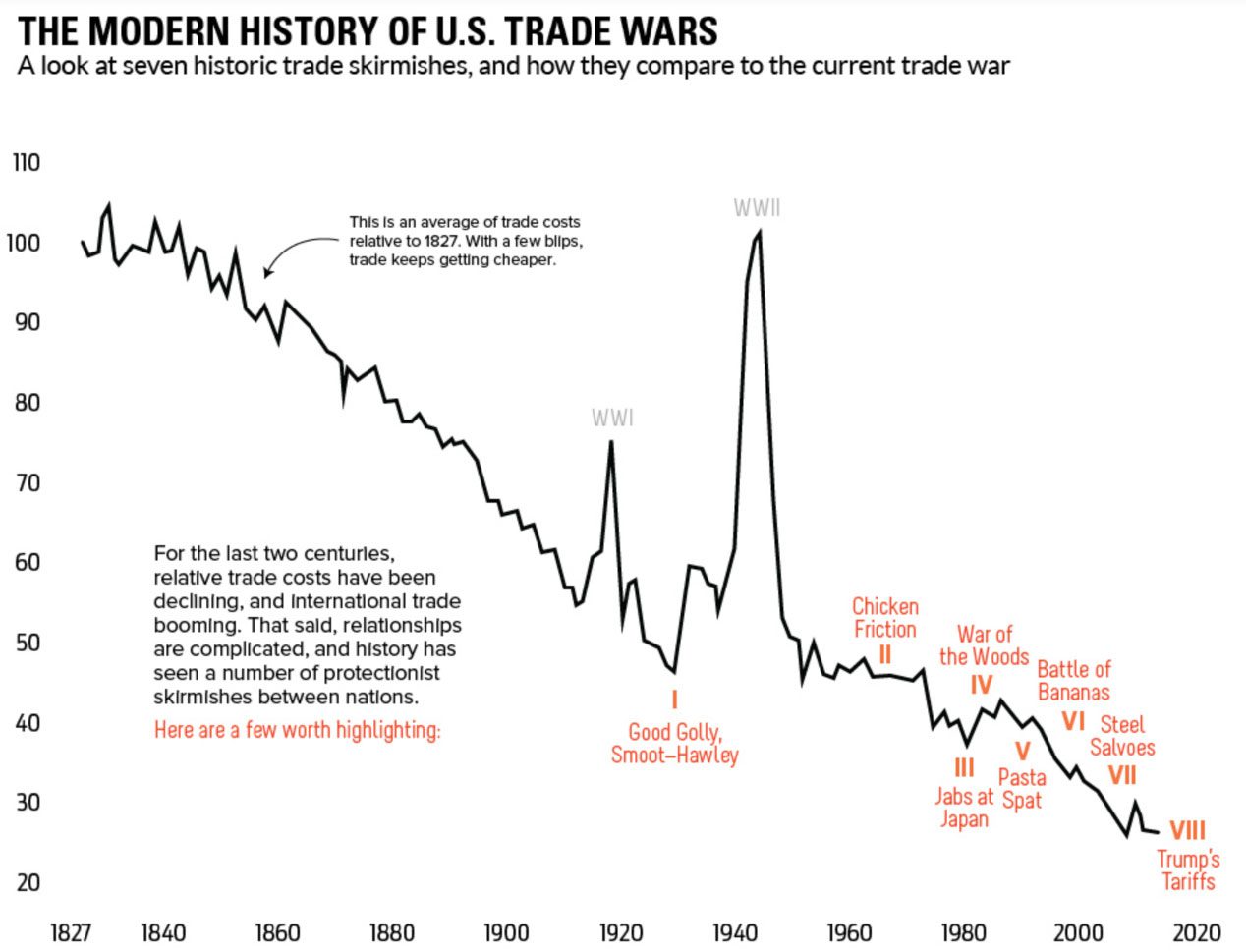

If history is any guide it may be very hard to find winners from this argument. The graph below shows the trade costs between nations, and since 1827 the cost of trading has been steadily reducing, except where trade wars have erupted. Visual Capitalist captures the story well as it looks at seven trade wars and compares with today’s environment. I’m going to summarise two of these incidents.

Source: Visual Capitalist

The first trade war we will look at was in 1930 when the US Smoot-Hawley Tariff Bill was passed, increasing taxes on 20,000 imported goods. In one year, imports into the US had dropped 66% and exports by 61%. This trade war is blamed as a contributor to the Great Depression.

More recently in circumstances similar to today’s, the booming Japanese car industry was putting US car makers under intense pressure, so in 1981 the Japanese agreed to export restraint measures which also extended to motorcycles and electronics.

Back to today’s trade war, Bloomberg economists have estimated the cost of the trade war at $1.2 trillion, if a solution is not found.

Let’s consider the case of a $2,000 Dell laptop computer. Dell is a US company, but its products are made in China. A 25% tariff adds $500 to the computer, a cost paid by businesses in the US. When the 25% tariff is added to many of the inputs to business, owners defer purchases and begin to prioritise which capital purchases are necessary. Overall, consumption and investment slows, cost of production increases, and the economy overall slows. Lower capital spending weakens the economy today, but also reduces future growth.

An economic slowdown, or worse a recession, is the last thing the global economy needs right now. For Australia, a slowdown in Chinese manufacturing will lead to a slowing of economic activity here with impacts on employment and capital investment.

So, who wins from a trade war? It’s hard to find any winners, except perhaps Mr. Trump himself.

At Capital Partners, we understand that life is filled with ups and downs. It’s complex. Certainty is in short supply. But with tailored, objective financial advice – advice built on evidence and your values and life goals – you can set the path for living your best life, whatever fate and circumstance throw at you. Discover how our evidence-based approach to wealth planning, investment management, legacy planning and insurance can help you live a healthier, happier life.