Wouldn’t it be nice to sit back and relax, safe in the knowledge that your juicy long-term share market returns were completely risk free? Well anyone reading the Australian Newspaper last week would have been shocked out of their armchairs thinking the world had come to an end… for financial markets at least.

After an extended period of relative calm on financial markets, recent days have seen a return of share market volatility and as a result a great deal of anxiety for investors. The first five days of February saw the US market fall by almost 6%, while in Australia the S&P/ASX 300 Index gave up almost 5% for the same period. 1

While the news media feasted on the drama of the market, it is really important for investors to remain composed and take a realistic view of what is really going on.

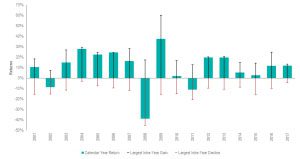

In Figure 1 below we show calendar year returns for the stock market since 2001, along with the largest intra-year decline that occurred during each given year. During the 17 years, the average intra-year decline was about 13%. In 60% of the years there was a decline of more than 10%, and about 40% of years had declines of more than 15%.

Figure 1: Australian Market Intra-Year Gains and Declines vs Calendar Year Returns 2001-2017

Despite these significant intra-year falls, the calendar year returns remained positive in 14 years out of the 17 years examined. This demonstrates that while share market declines are really very common, it remains difficult to determine whether a sell off during the year will result in negative returns over the entire year.

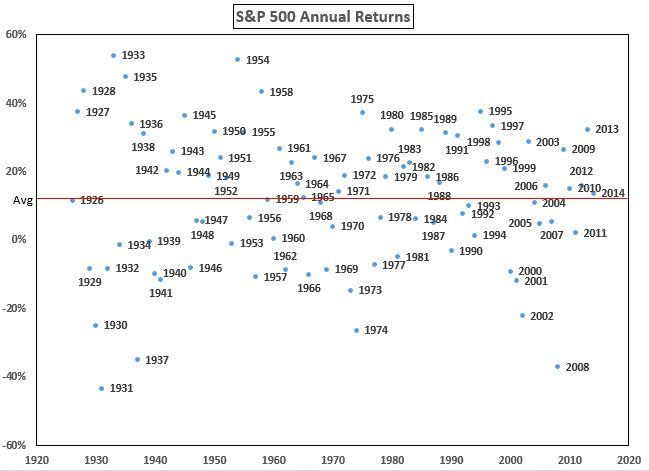

In the USA, the annual return from the S&P 500 index has been 10.16% per annum since 1926. Figure 2 below plots each annual return against the average long-term return.

Figure 2: S&P 500 Annual Returns 1926 to 2017 2

Figure 2: S&P 500 Annual Returns 1926 to 2017 2

What is so interesting in this simple analysis is that despite the healthy average return, there are 23 years with a return less than zero.

So as we settle back into a period of ‘normal’ volatility, it pays for investors to remember that part of the price we pay for higher returns from the share market is the uncertainty markets bring.

So when markets wobble, will you waver or will you look through the volatility and focus on the long term returns markets deliver?

In my next article I will be looking at the price paid in returns when an investor chooses to sit on the sidelines. Sometimes a matter of days out of the market can make a significant difference to long term returns.

You can read more articles about investing, or visit SmartInvestor.TV for some great video content.

Capital Partners is the FPA Professional Practice of the Year, and is committed to helping people live richer, happier lives.

1 The fall in the S&P/ASX 300 index was measured from February 2–6. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. S&P/ASX data copyright 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

2 With thanks to Ben Carlson, A Wealth of Common Sense.