When markets tumble as they inevitably do from time to time – we always wake to a headline like the one in last Wednesday’s Australian newspaper. Designed to shake you to your boots, we are left pondering the impact on our own investment fortunes. We’re only human after all.

For those who don’t work in financial markets, a severe market down turn is really the only time you will take any real notice of what’s going on with your portfolio. The evidence is that internet traffic, measured by the number of clicks, increases significantly when markets jitter and people seek out answers.

Here’s a couple of facts to help you relax with your next coffee break. First, a one-day fall of over two per cent doesn’t represent a crisis. In fact, it occurs often. Volatility tends to cluster around concentrated periods of time where you will see multiple down days in a period of a week or a month. When combined these down-days add up to ten days or more, we refer to it as a correction.

In a recent column Ben Carlson reviewed the S&P500 index back to 1928, looking for the number of days where the market fell by 3% or more. As it turns out there has been 325 days of greater than 3% falls over the last 90 years. That works out to an average of about 3 days every year when there has been a 3% or greater, down day.

When it comes to these down days what should an investor do? Buy more? Sell down? Do nothing?

When we consider this question, we need to think about what we are trying to achieve. If your goal is to avoid further market turmoil you could exit the market. Problem is that the biggest market return days tend to occur immediately after big market sell offs.

If you want to take advantage of lower prices by buying, markets could fall further.

Regular readers of mine will know that I have spent years trying to understand how and why markets behave the way they do. If I had the perfect crystal ball I can assure you I would share the secret with you.

Markets are unpredictable. In this current sell-off situation I’m going to suggest that markets had got ahead of themselves, particularly overseas, and that this correction is well over due. Markets are very efficient, but they are not perfect, what’s more we can’t control them.

Markets are unpredictable. In this current sell-off situation I’m going to suggest that markets had got ahead of themselves, particularly overseas, and that this correction is well over due. Markets are very efficient, but they are not perfect, what’s more we can’t control them.

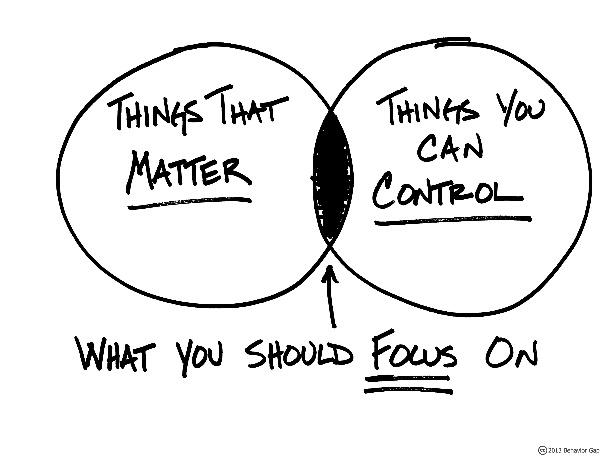

That’s why I have included my all time favourite BehaviourGap sketch because it is a great reminder for life as well as how we interact with financial markets.

Right now, at home, my wife is concerned about whether our youngest son will pass his derivatives and options exam. Does it matter – Yes. Can she control the outcome – No. So, don’t worry about it.

Similarly, with markets. Does your portfolio security matter? Yes of course. Can you control markets? Of course not. All the work in relation to a portfolio needs to be done before the volatility arrives. If the portfolio has been constructed with your personal needs in mind there should be very few sleepless nights.

Capital Partners is the FPA Professional Practice of the Year and the IFA Boutique Advice Firm of the Year. We are committed to the upholding the highest fiduciary standards, ensuring that the people who team up with us will live richer, happier lives.