The upcoming US presidential election will be pivotal for the direction of financial regulation and the economy, not just for Americans, but across the globe. The US elections are too close to call and have many variables associated with them. What are the implications of either side winning the election for Australian investors?

If you’re nervous about the markets as the US Presidential election approaches, you’re not alone.

There is a lot already written about how some of the policies being put forward by both camps may influence the US economy, and by extension what effect this may have on the US stock and bond market. But how does the outcome of the US election affect investors here in Australia?

The first point to make is the election is truly too close to call. Donald Trump has been leading the national vote for most of this year, but Kamala Harris’ candidacy has reinvigorated the voting electorate within the Democratic Party and most independent polls (ie.,https://www.realclearpolitics.com) now have Harris slightly ahead in the national polls. But the election will come down to a handful of “swing” states, where there is no clear consensus on who might take the majority of electoral college votes.

What can Australian investors expect depending on who is the eventual winner? Most likely if Harris wins there will be little change from the policies of the previous 4 years, at least as far as the rest of the world is concerned. On geopolitics, one would expect much the same level of support for Ukraine, Israel and attitudes towards China as the previous Administration.

Conversely, a second term for Donald Trump could introduce policies with global repercussions. Most commentators would agree that he would likely put pressure on NATO and focus on more aggressive protectionist trade policies. Coupled with slower immigration and lower taxes, that may drive US inflation higher, which potentially would push up the US dollar.

Trump will have a more hands off approach to global conflict. For example, most likely there would be fewer sanctions and less support for Ukraine. While Taiwan’s independence has enjoyed bipartisan support in Congress as both parties have taken a tough stance on China’s influence in the region, Trump may view the democratically governed island in a harsher light.

Either winner may have implications to the AUKUS trilateral security partnership between Australia, the United Kingdom, and the United States, which aims to bolster security and defence interests. A potential consequence of the AUKUS arrangement is an accompanying impact on our economic relations with China, by far our biggest economic partner.

One may expect that if the Democrats win office, then the US Federal Reserve remains an independent body, and that broadly regulation around banks and corporations will remain as it has in the last 4 years. On the other hand, Republicans are more likely to push for lower regulation and Trump will likely try and politicize the Federal Reserve by reducing their independence. This may have a complex push-pull effect on markets.

However, any effect on the US stock market will not necessarily translate to the Australian stock market, as the path of inflation and central bank actions have been different over the last 4 years and will remain on independent paths.

It is worth noting that Presidents do not have supreme power – they still need Congress to ratify their policies. And currently the elections for the Senate and the House of Representatives are just as tight as the overall Presidential election. The checks and balances between the Executive and the Congress make it very difficult for any sitting President to fully implement their political agenda.

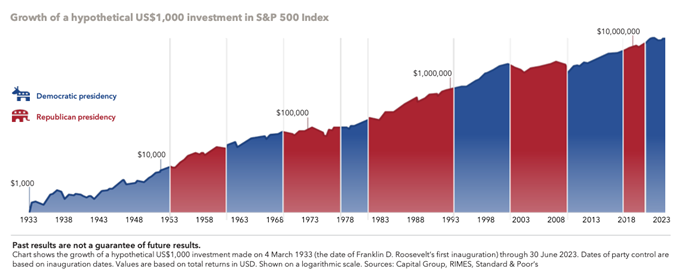

It’s natural for investors to look for a connection between who wins the White House and which way stocks will go. But regardless of who wins, as shown in the graphic below nearly a century of returns shows that stocks have trended upward. Politics can elicit strong emotions and biases, but investors would be wise to tune out the noise and focus on the long term. Successful investors stay the course and rely on time in the market rather than timing the market.

Dr Steve Garth PhD, M.App.Fin., BSc., BA. is the Principal of Principia Investment Consultants and works with Capital Partners assisting with communications.

For nearly two decades, Steve played a key role in helping grow the Australian arm of a global asset manager. During his career, he managed Australian and global equity portfolios, managed the Asia Pacific trading team and for the last 10 years he managed the firm’s fixed interest strategies.

Steve received his PhD in Applied Mathematics from the Australian National University. He also holds a BSc in Mathematics and Physics, a BA with majors in History and Politics, a Master of Applied Finance.