While geographic diversification once offered clear benefits, today’s globally integrated markets and multinational companies mean that country diversification provides less protection than in the past. However, industry sector diversification cushions against sector-specific shocks and improves resilience across market cycles. Investors may achieve better results by focusing on sector diversification rather than geographic spread.

Country diversification has traditionally been seen as a cornerstone of sound investment strategy, based on the principle that different countries’ economies and markets move independently, thereby spreading risk. However, in today’s globalized and interconnected financial landscape, the relevance of country diversification has diminished.

One key reason is the increasing correlation between global markets. Economic events in one major economy, such as the United States or China, often have immediate ripple effects across the world. For instance, interest rate changes by the U.S. Federal Reserve, economic slowdowns in China, or geopolitical tensions can cause synchronized market reactions globally. As a result, the risk-reducing benefits of holding assets in different countries have been eroded.

Furthermore, multinational corporations now dominate stock indices across the globe. A significant portion of the revenue generated by large-cap companies—regardless of where they are headquartered—comes from international markets. Therefore, investing in such companies provides indirect exposure to multiple regions, making traditional country distinctions less meaningful in portfolio construction.

However, industry sector diversification limits exposure to any single economic segment. Different sectors of the economy—such as technology, healthcare, energy, or consumer goods—tend to perform differently depending on macroeconomic conditions, regulatory changes, and consumer demand. By spreading investments across sectors, investors are less vulnerable to downturns that may disproportionately affect one area.

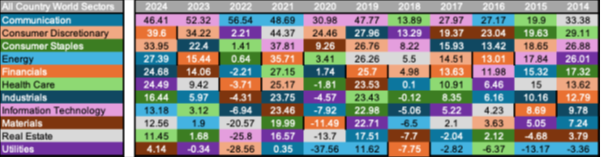

The below chart shows a “mosaic” of how different industry sectors have performed on an annual basis over the last 10 years. While we know that the IT sector – led by the big US tech stocks – has had strong performance over many years, the chart gives warning that this sector is not always the winner and may not remain so going forward.

Another reason to diversify across sectors is because dominant sectors tend to arise when there is a concentration in only a handful of large stocks. This can mean that the strong performance of a particular sector is due to the strong performance of only a few large companies.

Australia has long had a top-heavy benchmark in which a small group of companies make up a large share of the index. For the longest period, BHP held the number one crown, surpassed by Telstra in the late 1990s before relenting back to BHP and then more recently being overtaken by Commonwealth Bank. Currently, the Financial and Materials sectors make up close to 50% of the ASX.

The US equity market has its own concentration issues with the magnificent seven – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – making up around 35% of the market cap of the S&P 500.

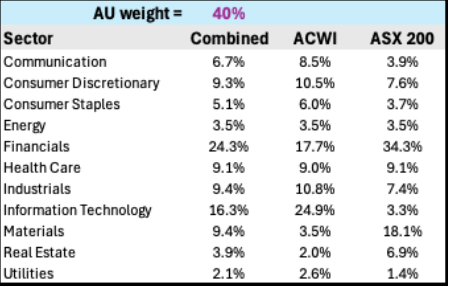

However, when looked at through the lens of the MSCI All Country World Index (ACWI), the IT sector accounts for a more modest 25%. Given that the IT sector in Australia is only 3% of the ASX, the benefits of combining domestic equities with international equities to spread the weighting of sectors in a diversified portfolio are clear.

The above table shows the weights of the different sectors for ASX 200, the MSCI ACWI, and a combination of 40% ASX / 60% ACWI.

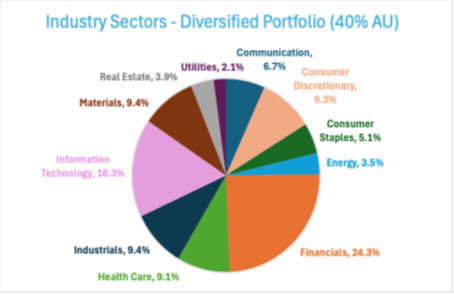

The pie chart gives a visual representation of how the sector weights are more spread in the diversified 40/60 portfolio. Financials are still the largest sector at around 24%, while IT and Communications are similar with a combined weight of 23%. Materials, Industrials, Consumer Discretionary and Health Care are all evenly weighted at around 9% each.

Global diversification opens up access to markets and sectors that may not be available or are a very small part of our home market. There are good reasons to overweight Australian equities relative to their weight in the ACWI (which is less than 2%), including familiarity with stock names and tax considerations. However, it is important to also focus on the balance of sector weights.

Sector diversification supports better long-term performance by capturing growth from multiple parts of the economy. Over different business cycles, leadership rotates among sectors, and a well-diversified portfolio can benefit from these shifts without needing constant reallocation.

Dr Steve Garth

June 2025

Dr Steve Garth PhD, M.App.Fin., BSc., BA. is the Principal of Principia Investment Consultants and works with Capital Partners assisting with communications.

For nearly two decades, Steve played a key role in helping grow the Australian arm of a global asset manager. During his career, he managed Australian and global equity portfolios, managed the Asia Pacific trading team and for the last 10 years he managed the firm’s fixed interest strategies.

Steve received his PhD in Applied Mathematics from the Australian National University. He also holds a BSc in Mathematics and Physics, a BA with majors in History and Politics, a Master of Applied Finance.