For many investors the bond market is like the dark side of the moon – a mysterious and unknown landscape. While the turmoil in the stock market made all the news headlines as President Trump announced larger than expected tariffs, the real danger to world order was lurking in the bond market. It was not stock market volatility that made Trump put the tariffs on hold – it was rising Treasury yields.

The week ending April 11th will go down in history as among the most dramatic and significant weeks in financial markets, regardless of what happens next. Higher tariffs on imports from 57 countries, ranging from 10% to 50%, were scheduled to take effect on April 9 but in an abrupt reversal later the same day were suspended for 90 days, bringing tariff levels to a universal 10%. China was not included in the pause and instead, tariffs on their exports were raised to 125%.

While stock market volatility reflected global uncertainty, the bond market signalled a deeper shift in capital flows.

Stocks are generally seen as a risky type of asset, while bonds are known as a “safe haven”, with the two typically moving in opposite directions. That’s because US government bonds — a type of security sold to help finance expenditures, to be paid back to buyers with interest over a set period — are backed by the full faith and credit of the United States.

But US Government bonds have been selling off (yields have been rising) while stocks have plunged. Rising yields suggest weaker investor demand, often driven by inflation fears or doubts about the issuer’s repayment ability. For governments, this reflects on the prospects for the country’s economy and finances.

Furthermore, the value of the US dollar relative to other global currencies has nosedived. Rising yields reflect reduced investor demand, often driven by concerns over the issuer’s repayment ability and other factors. As a result, the theory goes, the dollar appreciates relative to other currencies.

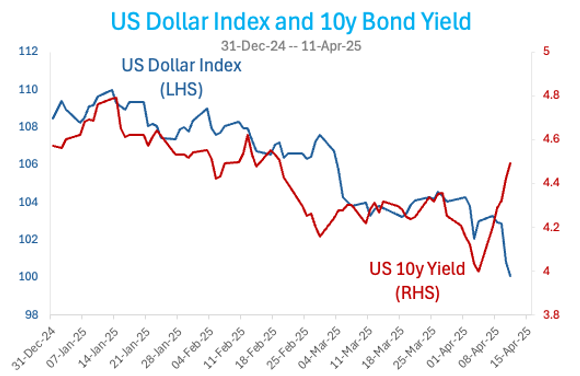

The chart below shows a sharp rise in U.S. 10-year Treasury yields and a drop in the U.S. Dollar Index. This combination is unusual and signals a sudden shift in investor sentiment.

It’s a warning sign that economists, analysts, and traders are still trying to understand.

Soaring yields on Treasurys make it costlier for the federal government to borrow money. It’s also bad news for consumers, as 10-year yields influence rates on mortgages, credit cards, and loans. Yields rising this fast raise concerns that Trump’s tariff policies may send the US into a recession.

There are several possible reasons for the jump in yields. One involves hedge funds and their complex bond market strategies. Another is that investors expect inflation and want higher rates to protect future returns. A third possibility: global investors may be losing confidence in America’s financial leadership.

Trump’s tariff and geopolitical shocks have shaken confidence in U.S. exceptionalism and the dollar’s safe-haven status. We may well look back at this moment and think of the end of America’s “exorbitant privilege”[2].

After weeks of market volatility over potential tariffs, the real power players—bond traders—finally took action.

After the government announced larger-than-expected tariffs, investors sold off U.S. Treasuries and the dollar dropped.

It was an ominous sign: global confidence in America’s financial dominance was starting to crack.

The bond market sent a clear message—investors no longer guarantee faith in U.S. leadership.

In explaining his decision to pause reciprocal tariffs for 90 days, President Trump said, “…they were getting a little bit yippy, a little bit afraid.”

In 1993, Bill Clinton dropped his spending plans after bond rates jumped sharply from 5% to 8%. His Chief of Staff James Carville later said “… if there was reincarnation… I would like to come back as the bond market. You can intimidate everybody”. Donald Trump was not swayed to put his tariff plans on hold by “yippy” stock market volatility. It was the bond market.

What does all this mean for investors? As always, there is a lot of media attention to stock and bond market volatility when it happens, but volatility is just a regular and normal part of investing. Bond yields have already declined since the government paused the tariffs, and anyone reviewing a long-term US Treasuries chart will barely notice the brief spike. While the bond market made Trump blink, it is behaving exactly as it should as the market works through the uncertainty of Trump’s ever-changing tariff policies.

[1] The Dollar Index (“Dixie”) measures the U.S. dollar’s value against major trade partners—excluding the Chinese Yuan.

[2] The term “exorbitant privilege” refers to the benefits the United States has due to its own currency being the international reserve currency.

Dr Steve Garth

April, 2025

Dr Steve Garth PhD, M.App.Fin., BSc., BA. is the Principal of Principia Investment Consultants and works with Capital Partners assisting with communications.

For nearly two decades, Steve played a key role in helping grow the Australian arm of a global asset manager. During his career, he managed Australian and global equity portfolios, managed the Asia Pacific trading team and for the last 10 years he managed the firm’s fixed interest strategies.

Steve received his PhD in Applied Mathematics from the Australian National University. He also holds a BSc in Mathematics and Physics, a BA with majors in History and Politics, a Master of Applied Finance.