New Market Highs: Is this a good time to invest?

During 2017 the US stock market was strong, to the point where the S&P 500 index reached a new high, 62 times out of 251 trading days. This means that 25 per cent of all trading days represented a new market high. But some investors become quite unsettled on news of new market highs, “surely the end of the run must come soon?”, they ask.

So let’s examine this concern. With stock markets reaching new highs, does it mean we can expect negative returns around the corner? This is a very interesting question and if an investor or wealth management adviser had the answer they could time their exit from the market to avoid any downturn.

How are stock prices set?

It is important to recap on how stock prices are set. Each day, millions of market participants take a view on the value of each stock, and current prices reflect the discounted value of the future cash-flows expected by those buyers and sellers. If investors believe the future cash-flows are very secure they will pay a higher price, and if future cash-flows are uncertain, they will likely want to pay a lower price. Therefore, a trade can only occur where the price reaches a level where the buyer expects to earn a positive return.

Using this logic, we can see that the expected return of buyers is always positive, otherwise why would buyers transact at a given price? While expected returns are always positive, these expectations are not guaranteed, and actual returns may fall short of expectations. This often occurs when new information enters the market and investors’ expectations are reset.

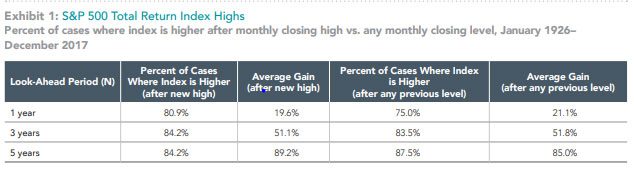

The diagram below measures monthly closing levels of the S&P 500 index from January 1926 to December 2017. Of the 1,103 months observed almost one third represented a new high. This should not be a surprise because markets generally rise over time, so by definition new highs should happen quite regularly.

With this knowledge we pose the question: If new market highs were a troubling development, why would we invest at all? After all, we invest to grow our investment, and by definition this means markets must regularly reach new highs.

This data also shows that looking ahead on a one-, three-, and five-year basis, the percent of cases when the index was higher or lower after a new market high is about the same when compared to any other previous price level. In other words, positive and negative returns tended to make up a similar proportion of returns after the fact, regardless of whether a new high was reached or not.

For example, for a three-year look-ahead period, the index was higher around 84% of the time both after hitting a new closing high as well as after any other previous level.

Can a market high predict a fall?

The question of whether a new market high is a good predictor for a fall in stocks can also be framed as, “is this a good time for me to be invested in the market?” The evidence suggests that the current state of the market isn’t particularly helpful in answering this question.

A decision to invest in shares will always be individual and will need to consider the investor’s return and risk objectives. However, once a decision is made to invest in the stock market, a disciplined, long term view is likely a more prudent course of action than being concerned about new market highs.

You can read more articles about investing, or visit SmartInvestor.TV for some great video content.

Capital Partners is the FPA Professional Practice of the Year, and is committed to helping people live richer, happier lives.