By David Andrew and Damon Sugden

First a bit of background. Dividends are the cash payments made by companies to their shareholders from their after-tax profits. To ensure dividends aren’t taxed twice, cash dividends come with a ‘franking credit’ informing the ATO of the amount already paid. This system is known as dividend imputation.

This system of preventing double taxation was introduced by Treasurer Keating in 1987, in what he claimed as a world first. Back then the system allowed taxpayers to offset their franking credits against other tax payable. Under these original rules if there was no other taxable income the taxpayer could not take advantage of the franking credits.

This all changed in 2000 when Treasurer Costello made unused franking credits refundable. This system of refunds means that some taxpayers end up paying negative tax. While the system of refunds is very generous, perhaps too generous, the fact remains many Australian retirees have made plans based on the rules of the day. This means the proposed changes under a Labor government will create a significant upset for many self-funded retirees.

Who will be impacted?

The answer is, just about every self-funded retiree in the country. Self-managed fund members receiving retirement pensions stand to lose the most as their incomes from other sources tend to be minimal.

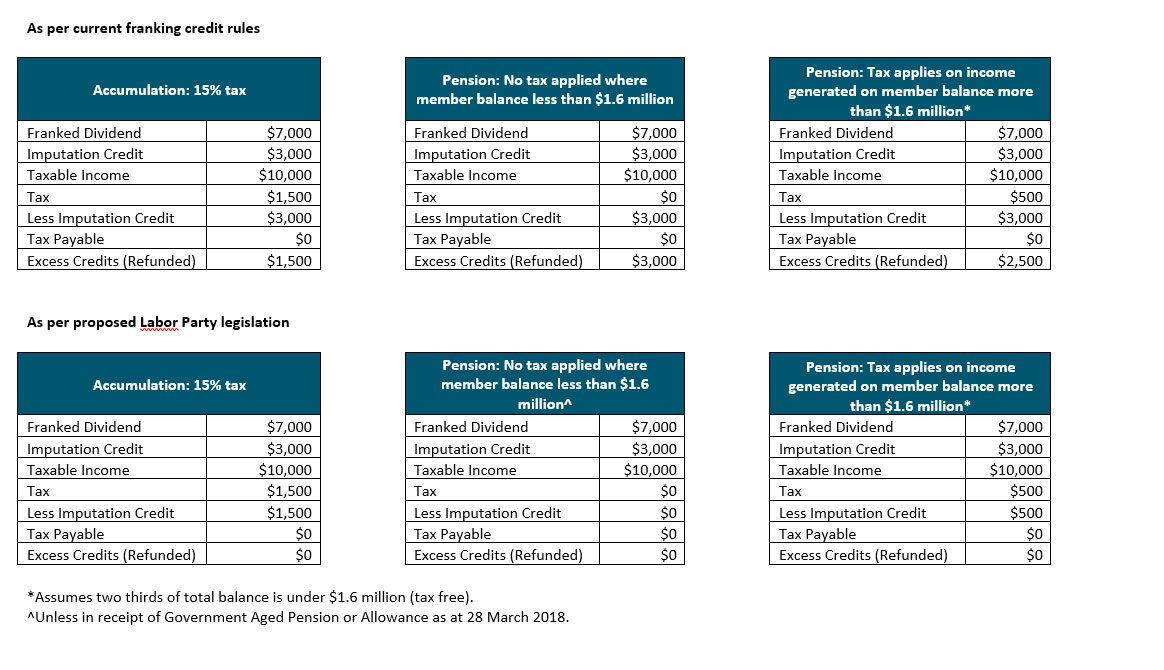

To help explain the impact we have presented three SMSF scenarios where the member receives a fully franked divided of $7,000.

To help explain the before and after scenarios, each of the tables shown reflect different life stages and tax situations depending on the investor’s superannuation balance. To simplify the comparisons, we have assumed a $10,000 dividend for all scenarios, $7,000 received in cash and $3,000 in the form of a franking credit.

To help explain the before and after scenarios, each of the tables shown reflect different life stages and tax situations depending on the investor’s superannuation balance. To simplify the comparisons, we have assumed a $10,000 dividend for all scenarios, $7,000 received in cash and $3,000 in the form of a franking credit.

- The ‘Accumulation’ scenario reflects how franked dividends are taxed (generally at 15%) prior to retirement or age 65.

- The second column of tables shows no tax is applied to a retiree or super member above age 65, in what’s known as ‘Pension’ phase, provided that your total balance is under $1.6 million.

- The final scenario shows the effect of a retiree who has $1,600,000 in pension phase and a further $760,900 remaining in the accumulation account.

In a move that has been criticised by many in the press, Labor has provided protection for those receiving the Age Pension through the proposed ‘Pensioner Guarantee’, ensuring that those in receipt of a Government pension, or allowance as at 28 March 2018, will continue to be eligible for cash refunds relating to unused imputation credits. This sets up a significant inequity between those on government benefits and their friends and neighbours who have worked hard to fund their own retirement.

Adding to the inequity, it is likelihood that investors in industry superannuation and public offer superannuation funds, (but not SMSF members), will still receive some benefit from offsetting franking credits with other tax-paying members of the fund.

Putting politics aside, this proposed legislation is very poor public policy and penalises those who have made considerable effort to be independent and self-funded, and therefore not a burden on the public purse. On this count alone we hope the Senate will not pass this legislation.

So, what to do?

While this matter is causing concern for many investors, cool heads need to prevail. Anything can happen between now and the May 18 election although it seems that Labor is in a very strong position. Until the result of the election is known it is best to wait to see whether Labor is elected with a majority large enough to pass these changes. Even then, the composition of the Senate will determine the outcome.

Should the legislation prevail, we will be considering every possibility to assist our clients. Our preliminary thoughts include:

- Wind up your Self-Managed Super Fund in favour of a pooled superannuation account, where franking credits from accumulation members can still be used to offset their tax;

- Maintain your Self-Managed Super Fund and add younger accumulation family members, providing a source of taxed investment and contribution income, against which franking credits can be used to offset tax payable;

- As a final straw, spend down capital down on say home renovations, travel, additional lifestyle, family gifts or pre-paid funeral expenses in attempt to qualify for an Aged Pension or Centrelink allowance benefits. You would then become eligible for your franking credits!

The simple explanation for Dividend Imputation: to avoid taxing company profits twice, tax must be paid at either the company or individual level, but not both. If it were paid only at a company level, high income people would benefit from the 30% tax rate. So our system taxes company profits at the individual’s level. Any tax already paid by the company is refunded.

For further discussion on this issue, you can watch our recent video here.

Other interesting reading

The real story of Labor’s Dividend Imputation Reforms – Inside Story

Franking Credits Made Easy – Cuffe Links

In a world filled with political, economic and social uncertainty, sound financial advice – advice based on evidence and your values and life goals – holds the key to a happier, healthier life. This is what we believe at Capital Partners. And our experience helping hundreds of clients build wealth with purpose bears this out. Read more about our evidence-based approach to wealth planning, investment management, legacy planning and insurance.