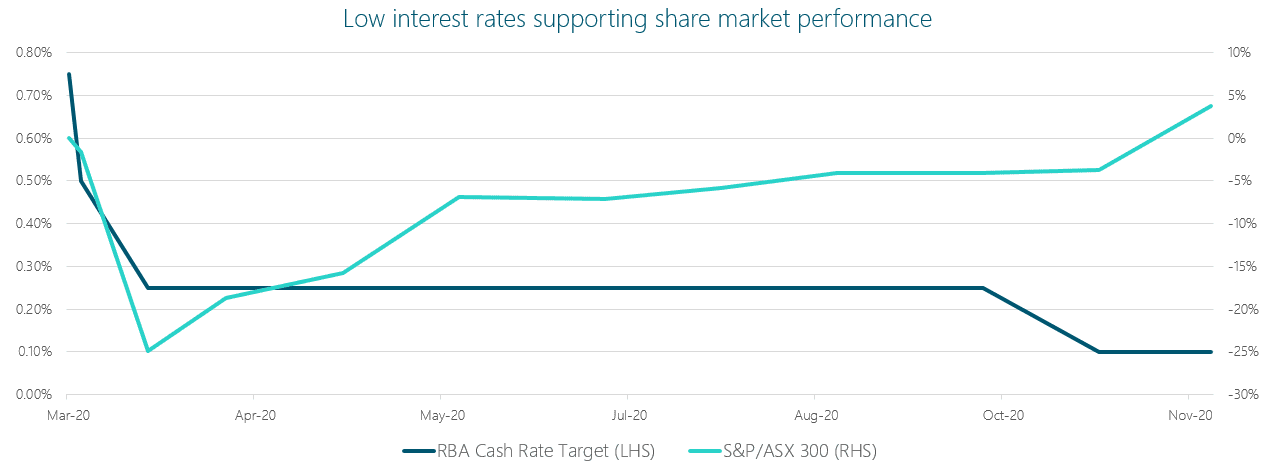

Setbacks aside, markets appear to be sprinting to the finish line this year with November producing the best one-month performance across share markets since 1988. A perfect demonstration of the forward-looking nature of share markets and how it is entirely possible for shares to rebound and perform well, at a time when market indicators, like employment and inflation, are well below desired levels.

Not surprisingly, market performance following the Covid-crash in March has been largely dependent on recovery measures and vaccine developments. In this regard, there has been quite a lot for the market to be cheerful about recently. Just in the last couple of months, we’ve had announcements for additional stimulus, encouraging vaccine trial results, Australia exiting recession and potentially some political clarity in the US.

Low rates here to stay

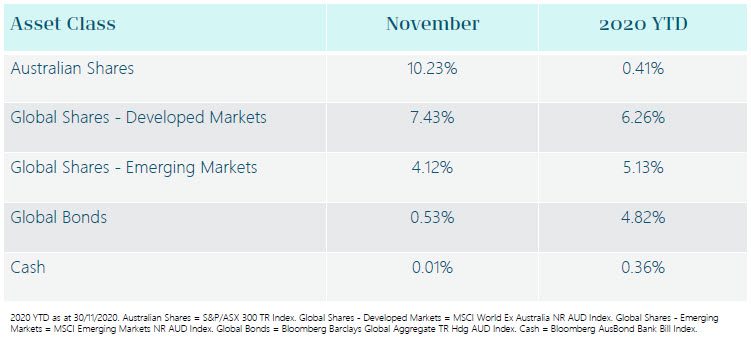

The rate cut on Melbourne Cup day was the RBA’s third for the year, and with inflation and employment targets still out of sight, the RBA has made no secret that we can expect to see low rates continue over the next few years. Of course, one of the secondary effects of low-interest rates is that it increases the present value of company valuations and therefore supports price growth in the share market as has been evident during the second half of this year.

Biden Bounce

Although Donald Trump is yet to concede officially, it is now highly likely that Joe Biden will assume the Oval Office in January. With the Republicans still on track to retain control in the Senate, the prospect of a policy status quo in Washington along with Biden’s more conventional approach to leadership appears to have encouraged investors. Joe Biden’s first three weeks as president-elect was the second-best start for a newly elected President ever, beaten only by Ronald Reagan in 1980.

In and out of recession

A better than expected September quarter saw Australia bounce out of recession as the country grew by 3.3 per cent. Ample stimulus finally led to a bounce in consumer spending across all states, except for Victoria, which spent the better part of the period in lockdown. With restrictions now mostly eased and another 9 billion dollars of fiscal stimulus announced in October, it is now expected that Australia’s growth will continue through to the new year.

Vaccine hopes

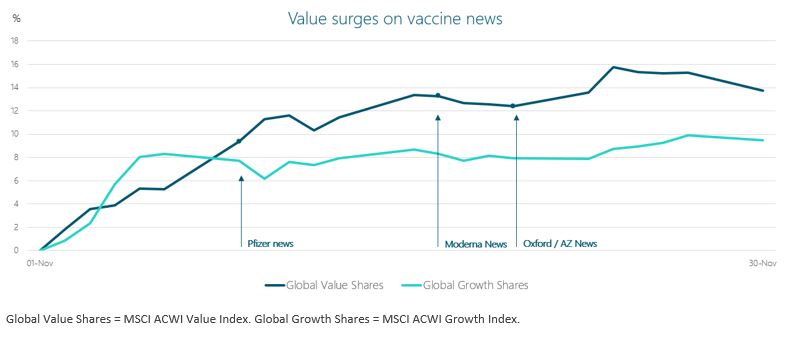

November was a big month for vaccine announcements, with three major healthcare groups announcing successful trials. Interestingly, off the back of this news, we have seen a rally within the more cyclical sectors such as financials, materials and energy. Sectors that are typically comprised of value companies or low relative-priced companies. In a post-vaccine recovery environment, we would generally expect these sectors to continue to perform well.

The year ahead..

The world will now shift its attention to vaccine approvals and rollout plans at a country level. Only time will tell how efficiently our global leaders and regulators can arrange for our population to be vaccinated. We’ve already seen the rapid rollout of the Pfizer vaccine in both the UK and the US. (Curiously two countries that have notoriously struggled to contain the virus.) It is still unknown whether vaccines will stop Covid-19 transmission, so there is concern that cases may continue to rise, and our recovery will be slower than markets are currently assuming.

On January 5th the final two seats in the US Senate will be decided in Georgia. While the Republicans are still favourites for a Senate majority, a Democratic upset could see markets become anxious about the Biden Administration’s power to repeal Trump’s corporate tax cuts, as well enforcing other policies that could impact corporate earnings.

In Australia, the souring of our relationship with China is a real concern. The fall out was highlighted by China imposing new tariffs on Australia’s wine exports, as well as banning the importation of coal and several other items. One would hope for a more diplomatic approach with our largest trading partner in the new year; however, should tensions worsen, it will certainly affect our recovery and dampen our growth prospects in the longer-term.

Appreciating that it will take time for the world to recover to pre-pandemic levels, we have a cautious outlook for the year ahead. Additionally, with company valuations now close to all-time highs, there is every chance we may see a correction or some increased volatility across share markets in the coming months. Looking through the short-term noise, the prospect of improving global growth should bode well for markets in the medium-term.