Every major currency in the world has fallen against the U.S. dollar this year, an unusually broad shift with significant consequences for the global economy. The strength of the greenback stems from a shift in expectations about when and by how much the Federal Reserve may cut its benchmark interest rate, which is at a 20-year high. The implications of a strong U.S. dollar are multifaceted, impacting everything from inflation to global trade dynamics.

Why the U.S. dollar is so strong

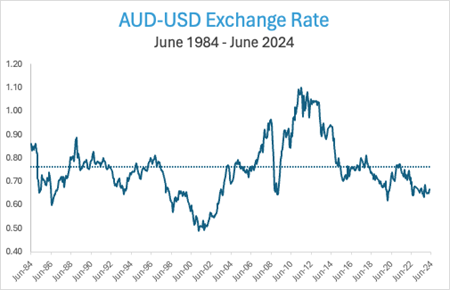

High U.S. interest rates, a response to stubborn inflation, have propelled the dollar to an unusually high level against other major currencies. The dollar index, a common measure of the U.S. currency’s strength against a basket of its major trading partners, is hovering at levels last seen in the early 2000s. For instance, the Australian dollar has been trading around 66 cents – below its 40-year average of 75 cents – for the last two years, while the Chinese yuan has shown notable signs of weakness despite officials’ efforts to stabilize it.

The dollar’s dominance is profound, as it is on one side of nearly 90 percent of all foreign exchange transactions. A stronger U.S. currency intensifies inflation abroad, as countries need to exchange more of their currencies for the same amount of dollar-denominated goods, including essential commodities like oil. Additionally, countries with dollar-denominated debt face higher interest payments, exacerbating their financial burdens.

The spike in inflation post-pandemic forced central banks to aggressively raise interest rates to keep it under control. After more than two years of the quickest interest-rate tightening cycle in decades, the U.S. now has one of the highest interest rates in the developed world, in the target range of 5.25% – 5.50%. In contrast, Australia’s cash rate has been at a more modest 4.35% since November 2023. Higher interest rates attract more foreign capital, strengthening a country’s currency.

The chart below shows the 40-year history of the Australian dollar against the U.S. dollar. While it is not presently at historic lows, the effect of the interest rate differential can be seen since June 2022.

Historically, Australia has had higher rates than the U.S., but this trend has reversed in the battle to combat inflation.

What markets expected—and what actually happened

Markets have been expecting U.S. interest rates to start falling – and the U.S. dollar to weaken – since the end of last year. The Federal Reserve had announced no further rate increases were planned. The next change would be a cut. However, persistent high prices have forced the Federal Reserve to maintain higher rates for longer, keeping the U.S. dollar stronger for an extended period.

Policymakers around the world are now balancing the choice between supporting their domestic economies by cutting interest rates or supporting their currency by keeping rates high. The longer they maintain high interest rates, the more their economies may suffer. It’s a tough choice.

Global pressures and local realities

China’s situation exemplifies this risk. A real estate crisis and sluggish domestic spending have battered its economy. Recently, China has relaxed its stance and allowed the yuan to weaken, demonstrating the pressure exerted by the strong U.S. dollar on financial markets and policy decisions worldwide.

While interest rate differentials significantly influence exchange rates, they are not the sole factor. In Australia, for example, the dollar is influenced by commodity prices, its largest trading partner China, and other global factors. Many investors expected the U.S. to begin cutting interest rates before Australia, which would have narrowed the interest rate differential and strengthened the Australian dollar. However, stubborn inflation has kept rates on hold in both countries, leaving those investors caught off guard While some commentators believe the AUD will return to its “average” AUS/USD rate of 75 cents, there is no certainty this will happen, or if it does, when it will occur.

What lies ahead?

The future of the U.S. dollar remains uncertain, as global currencies respond to shifting interest rates, inflation, and economic policies. While some expect the dollar to weaken as rates fall, the timing and scale of that shift are still unclear.

Policymakers and investors alike must navigate this uncertain landscape, balancing domestic economic needs with the pressures of a robust greenback.

This article was written by Dr Steve Garth | June 2024.

Dr Steve Garth PhD, M.App.Fin., BSc., BA. is the Principal of Principia Investment Consultants and works with Capital Partners assisting with communications.

For nearly two decades, Steve played a key role in helping grow the Australian arm of a global asset manager. During his career, he managed Australian and global equity portfolios, managed the Asia Pacific trading team and for the last 10 years he managed the firm’s fixed interest strategies.

Steve received his PhD in Applied Mathematics from the Australian National University. He also holds a BSc in Mathematics and Physics, a BA with majors in History and Politics, a Master of Applied Finance.