Bad movies leave us cold. It doesn’t matter if the cast is stellar or the storyline ambitious. When the credits roll, we feel short-changed. That’s how I felt after last week’s tariff announcement by President Trump. Frustrated. Annoyed, Wondering, “Surely, they can do better than this?”

Before we go any further this is not an anti-Trump rant, rather it’s a commentary on his strategy of unnecessarily creating chaos in well-established trading systems.

The scale and inconsistency of the tariff announcement is breathtaking. Markets have reacted swiftly, with a sharp sell-off in recent days. This morning’s reaction on Australia’s financial markets may be an overreaction but it will take time for us to understand the true impact of Mr Trumps policies.

At worst, this could mark the start of a new chapter—one defined by trade wars and economic readjustments. Since Mr Trump took office, tariffs have been an on-again, off-again affair with Canada and Mexico. Now, we’re left to see how long these latest measures stick, especially as he opens the door for US trade counterparties to come kowtowing to the emperor.

This is an interesting twist. If a country can present a case valuable enough it appears significant concessions may be on offer. I must say, it feels more like haggling at a sly grog shop than policymaking from the Whitehouse.

For Australians, the direct impact on our exports to the US is minimal. The real concern lies elsewhere. Tariffs targeting China and Japan—two of our largest trading partners—could ripple through their economies and slow global growth. A slowdown in China or Japan inevitably touches us here as demand for our metals and minerals falls. We have already seen this predicted in the fall of the Australian dollar.

What’s clear is that we’re in for four years of unpredictable policymaking from an unpredictable president. Scott Bessant, the Treasury Secretary and a seasoned veteran of financial markets, understands the damage tariffs can cause. Yet his lukewarm support for Mr Trump’s approach is troubling. It suggests even experienced hands are bending to the will of a leader who governs more by impulse than strategy.

A self-made mess

The global economy enters this chapter of uncertainty from a position of relative strength. The US economy has been booming, and we have had three years of strong financial markets. Europe has been shaking off its long slumber, while China’s growth has slowed amid property market struggles and weaker consumer demand, but the China story is far from over.

Most long-term investors have enjoyed several good years, but I understand that having spent some time in the sun doesn’t make the inevitable market downturn any easier to swallow.

We’ve seen financial markets rise and fall before. But this time does feel different because it’s entirely self-inflicted. Over the weekend, China announced retaliatory tariffs of 34%. Mr Trump’s response? He accused China of ‘panicking’ and ‘playing it wrong’. An interesting response to serious economic brinkmanship.

Uncertainty looms large. This could be the first prolonged market upheaval since the Global Financial Crisis—or it might just be a bump in the road. Federal Reserve Chair Jerome Powell has already warned that tariffs could trigger inflation and even recession. The worst-case scenario? Stagflation—a toxic mix of low growth and high inflation that Japan endured through much of the 1990s and 2000s.

Navigating uncertainty

In times like this, it’s tempting for me to offer reassurance that ‘everything will be fine’ because deep down, I believe this is true. The problem in the meantime is that no one knows how this will play out.

What we do know is that Mr Trump thrives on chaos but likely won’t want his legacy tarnished by economic decline. If his base starts to feel the pinch, their loyalty could evaporate as quickly as it formed.

Democratic systems are based on the separation of powers between, the judiciary, the legislature, and executive branch. This will be a crucial test for the legislature and the judiciary and let us hope that they stand up for themselves and do their job to protect the US constitution and its people.

Despite this uncertainty, I offer our clients a very real reason to be calm as this economic shock unfolds. At Capital Partners, our portfolios are designed to withstand shocks like these. We don’t know when or where the next disruption will come from—but we know they’re inevitable. Our investment approach proved its worth during the GFC and continues to offer protection now.

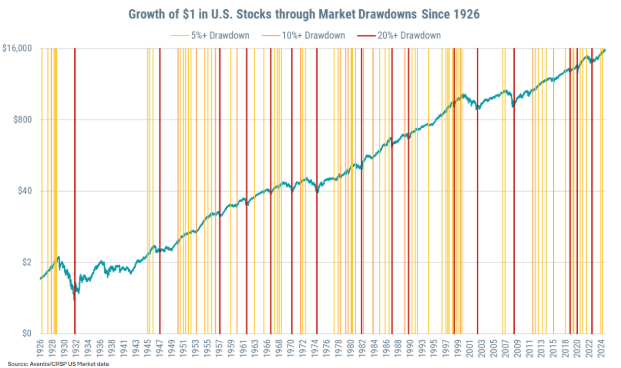

Every portfolio includes defensive assets—your safety net when growth markets falter. Market turmoil is part of investing; it’s uncomfortable but normal. As history shows, these periods pass.

The diagram above shows the number and depth of market downturns since 1926. There have been 16 years through history where the annual drawdown has been 20% or more. That’s every 6 years. While this information may not bring immediate comfort, it does support the idea that we have seen bad movies like this before.

Cybersecurity breaches for major Superannuation Funds

You may have read over the weekend that several major Australian superannuation funds have been targeted by cybersecurity criminals, resulting in the loss of retirement savings for some members.

The funds impacted were Australian Super, HostPlus, REST and the Australian Retirement Trust. The breaches appear to have been the result of stolen passwords sold on the dark web. It appears that these funds did not employ 2-Factor Authentication, today considered to be the most basic level of protection.

I want to assure all our investors that the major platform used for our clients’ administration is Macquarie Wrap, and it was not impacted by the recent breaches. Further, Macquarie employ bank-level security through their Authenticator App.

We’ve developed a comprehensive cyber security checklist to keep you safe online. If you’re feeling unsettled, now might be a good time to speak with your adviser. A measured conversation can help put things into perspective and ensure you’re well-prepared for whatever comes next.