With official interest rates in Australia at an historic low of 0.75 per cent, many investors are wondering what impact this will have on their portfolio, but more importantly their lifestyles. This article considers some of the issues investors need to be thinking about. In particular, how we should be thinking about the rate of return in excess of the cash and inflation rates, not just the top line number?

Pensioner Retirees

While the RBA is intent on stimulating the economy with lower interest rates, mortgage holders are clearly the biggest beneficiaries. For retirees though, particularly those on the Age Pension whose nest egg has been securely invested in term deposits, the news isn’t so good. It doesn’t take much to work out that the reduction in term deposit rates from five per cent for much of the past 20 years, to one per cent today is an 80 per cent pay cut.

The biggest risk these investors face today is that they start searching for higher yielding investments. Everyone is familiar with the saying ‘there’s no free lunch’ and this is certainly true in investing. The promise of a higher yielding investment can only be true if there is a higher risk.

Of particular concern will be the proliferation of higher yielding “deposit accounts” offering “higher returns for no more risk”. All investors should be sceptical of these claims as higher returns always come with higher risk. We saw this trend prior to the GFC and some of those products remain frozen today.

Self-funded retirees

Self-funded retirees are more likely to be invested in the share market, where a diversified portfolio of shares and bonds remains the best antidote to a low interest rate environment.

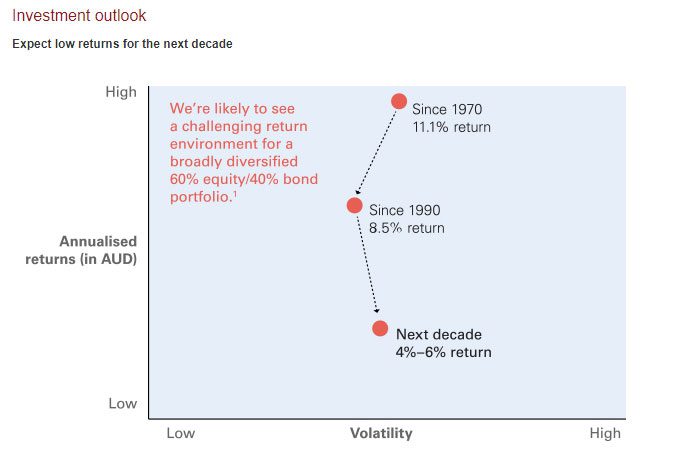

Since the 1970s the annualised return on a diversified portfolio of 60 per cent shares and 40 per cent bonds has been about 11 per cent. Since 1990, the same portfolio has returned 8.5 per cent and many economists are considering the likelihood of lower returns in the next decade. How should we be thinking about this possibility?

Figure 1: 60/40 Portfolio Returns since 1970. Source Vanguard

While lower portfolio returns may sound very concerning, it is important to note that inflation has also been in a steady decline for this period. Retiree lifestyles will be determined by their investment discipline, their spending habits and of course their returns in excess of the cash rate and inflation. With the decline of inflation, it may well be that the actual real return from a diversified portfolio has remained relatively stable. Let’s take a closer look.

We have never before experienced a period where very low interest rates were the norm. Through recent history inflation has been the bigger concern, and this spawned the establishment of independent central banks around the world to keep inflation in a band of 2-3 per cent. With inflation in Australia stubbornly low, the Reserve Bank has been steadily reducing the target cash rate with the goal of simulating economic growth and inflation.

What is the outlook for share market returns?

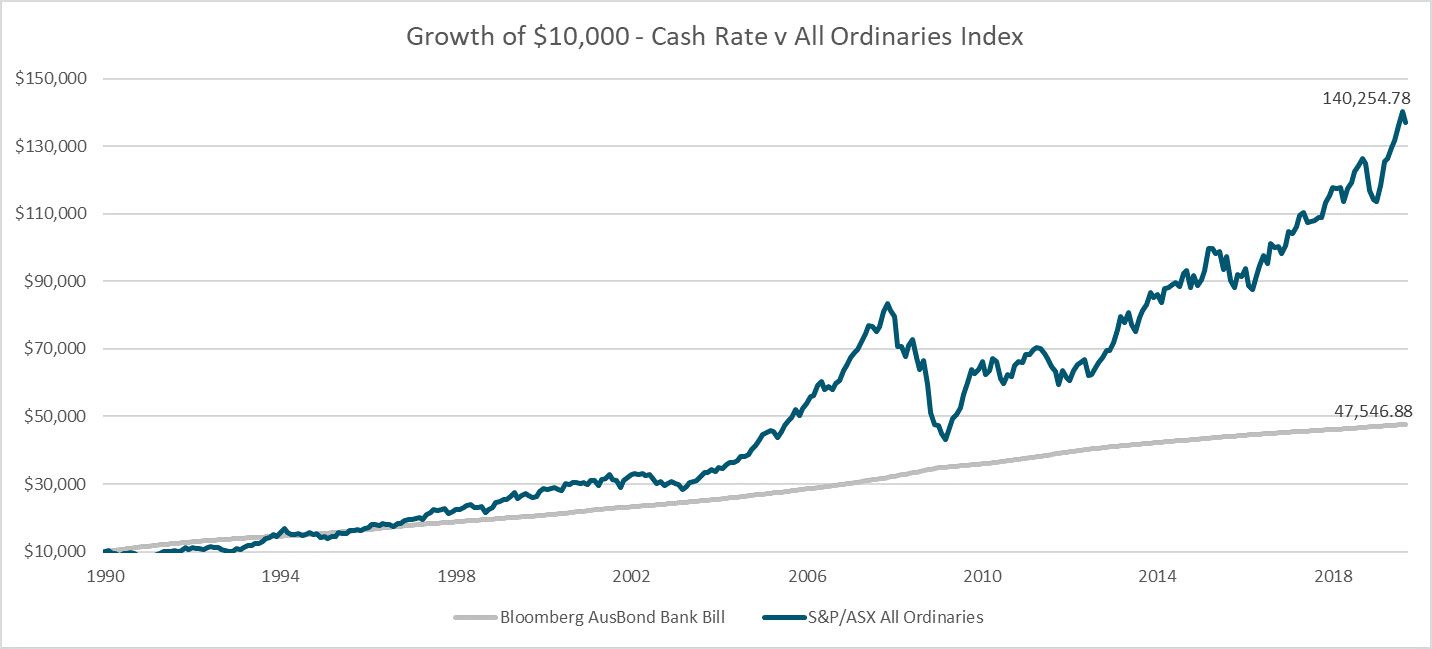

The truthful answer must be – “we really have no idea”. Many academics have tried to neatly place a value on the expected return over the risk-free rate, being cash, an investor should expect in compensation for investing in shares. What we can be confident about is that in the long term, investors will be compensated for the additional risks they take in investing in shares rather than cash. This neatly demonstrated in Figure 2 where the cumulative growth of a diversified share market investment is in sharp contrast to the return from cash.

Figure 2: Growth of Wealth Australian Cash v Shares. Source – Morningstar, Analysis – Capital Partners Consulting

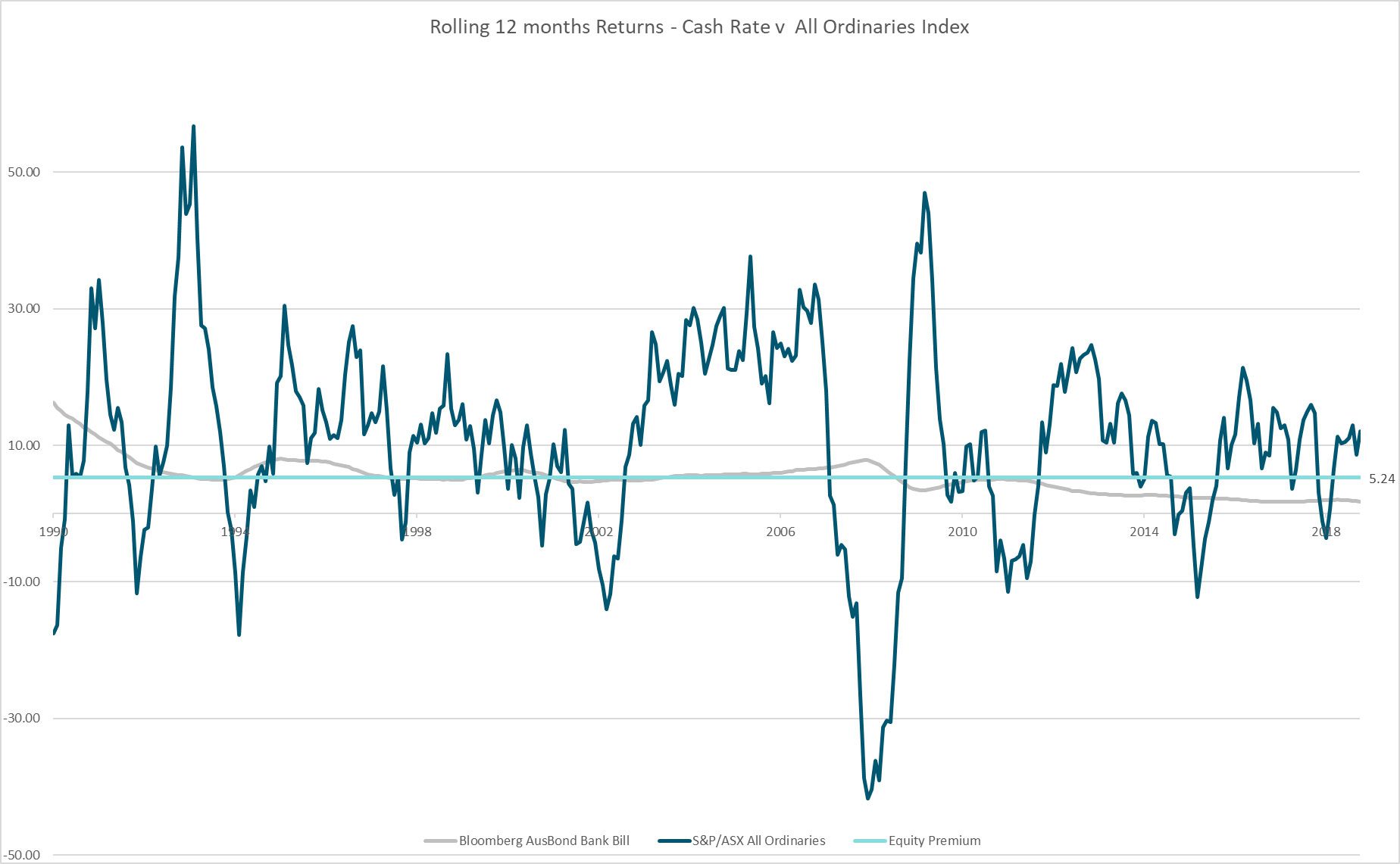

Over the past 28 years interest rates have fallen from 16.25 per cent for the year ended December 1990, to 1.92 per cent for the year ended December 2018. During this period the equity market premium averaged 5.24 per cent. That is, over the period an investor received a return on average of 5.24 cent each year in excess of the cash return.

For the whole period the All Ordinaries Index provided an average annual return of 10.53 per cent, while the average cash return was 5.29 per cent.

Figure 3: Rolling 12 month returns – Cash v All Ordinaries Index. Source Morningstar. Analysis: Capital Partners Consulting

To summarise, let’s assume that interest rates will be in a range of 1-3 per cent per annum over the next 20 years. If our expectation of a long-term equity market premium of 5 per cent holds true, then share market returns in the range of 6-8 per cent per annum appear reasonable.

Low inflation saves the day

It would be easy to be fearful of these lower expected returns, however research of share market returns from 1900-2014, suggest that the 114-year inflation adjusted share market return in Australia was 7.3 per cent. Perhaps in a low inflation environment our real share market returns won’t be that different after all.