In recent years, the rise in interest rates from 0.1% in 2021 to 4.35% has significantly impacted mortgage holders. However, investors favouring the security of term deposits have welcomed the increased returns. Despite this, inflation remains a major issue, eroding the income generated from these deposits.

At the start of 2023, 12-month term deposit rates averaged 3.7%. An investor who purchased a one-year term deposit in January 2023 would receive their principal plus 3.7% interest by January 2024. However, with the year-on-year inflation rate at 4.1% as of December 31, 2023, the real return on this investment is negative. Inflation has outpaced the term deposit’s returns, and this is further exacerbated if the investor is taxed on the interest income.

The situation is improved today. As of May 2024, the average 1-year term deposit rate is 4.45%. Although inflation is decreasing, it is not declining as quickly as desired. The RBA predicts that core inflation will not fall back to its target range of 2% to 3% until late 2025. Investors must be cautious of cash rate-linked nominal returns that are negated by inflation and taxes.

Inflation affects every aspect of your financial strategy, influencing savings and investments broadly. Inflation involves a gradual increase in the average price of goods and services over time, and while it might seem benign initially, its impacts can be profound. To combat inflation, investing in a portfolio of risk assets such as equities and bonds is essential. A balanced portfolio, combining growth assets like equities with stable assets like high-quality fixed interest securities, offers protection against inflation.

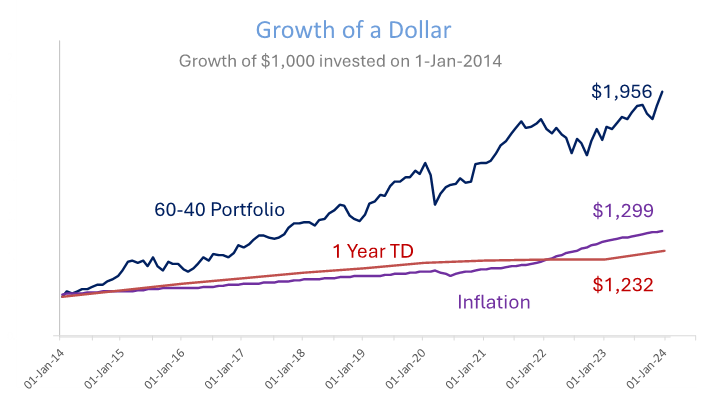

The following chart illustrates the growth of $1000 invested in a one-year term deposit, starting in 2014 and re-invested each year at the prevailing rate. This is contrasted with $1000 invested in a 60-40 balanced portfolio, and with inflation, measured by the Consumer Price Index.

Due to inflation, the purchasing power of the original $1000 invested in term deposits has essentially ‘lost value’ over time. That means that investing in rolling TD’s over the last 10 years has resulted in your wealth going backwards in real terms. The 60-40 portfolio, which is considered conservative by Australian standards, would have grown to $1,956, effectively doubling the investment over ten years and significantly outperforming inflation.

In light of the poor performance of equities and the bond market in 2022, it is understandable why some investors were drawn to the stability of term deposits. However, the inflation-adjusted returns of these deposits can be disappointing.

To mitigate the adverse effects of inflation, seek assets that offer returns above the inflation rate. This often involves investing in long-term wealth-protecting assets like equities, real estate, and bonds, which historically have outperformed inflation.

Holding cash and term deposits will always play some role in your financial plan. How much you hold in this asset class will be dependent on your tolerance for risk, capacity for risk, and the investment return you require to achieve your long-term goals.

Understanding inflation dynamics and developing a diverse investment portfolio is crucial for maintaining financial stability and ensuring your money retains its value in an ever-changing economic landscape. Term deposits provide security, but make sure you have the appropriate balance of assets so that inflation doesn’t erode your wealth.

Dr Steve Garth PhD, M.App.Fin., BSc., BA. is the Principal of Principia Investment Consultants and works with Capital Partners assisting with communications.

For nearly two decades, Steve played a key role in helping grow the Australian arm of a global asset manager. During his career, he managed Australian and global equity portfolios, managed the Asia Pacific trading team and for the last 10 years he managed the firm’s fixed interest strategies.

Steve received his PhD in Applied Mathematics from the Australian National University. He also holds a BSc in Mathematics and Physics, a BA with majors in History and Politics, a Master of Applied Finance.