Geopolitical events often cast a shadow of uncertainty over financial markets, leaving us feeling concerned about our investment strategy. When big conflicts like those between Israel-Palestine or Russia-Ukraine occur, it can trigger market volatility that can easily prompt knee-jerk reactions from investors. However, history has shown that geopolitical risks – like wars or political tensions – always exist, and they usually don’t have a long-lasting effect on the economy or markets.

Geopolitical events will create short-term market disturbances. Depending on the severity, we usually see the prices of gold and oil shoot up, and a shift towards “safe” investments like government bonds and cash. On the contrary, investors often stay away from what they see as riskier investments, like stocks.

So, when Hamas-led Palestinian militants crossed the Israeli border in a surprise attack in the early morning of October 7, oil and gold prices spiked close to 10%. This sharp jump in oil prices came as no surprise – about 21 percent of the world’s oil passes through the Strait of Hormuz, the thin stretch of water separating Oman and Iran, connecting the Persian Gulf to the Arabian Sea. Iran, which openly backs Hamas in Gaza and Hezbollah in Lebanon, is the world’s seventh-largest oil producer. This prompted global fears that the Israeli-Hamas conflict could lead to a wider Middle East war, disrupting oil supplies.

However, geopolitical events have never been a reason to panic sell. The Russia-Ukraine conflict is a great reminder of this. Global equity markets fell around 10% in the weeks immediately following the invasion. However, markets rebounded quickly, and a month later, shares were trading at a higher level than before the invasion, even as oil remained above $100 a barrel. Any investor that had sold to cash immediately after the invasion would have then been stuck wondering when to buy back in – at higher levels than when they sold – an incredibly tough decision given the war was still ongoing.

We have seen many other conflicts throughout history that have told a similar story. The Korean War, Cuban Missile Crisis, Suez Canal Crisis, the Iraq War, numerous other Middle East conflicts, and even the September 11 attacks all resulted in short-lived market corrections and quick recoveries.

To put the current Middle East crisis in context and demonstrate how quickly markets can move, as we speak, the oil price is now below the level it was trading before Hamas attacked Israel and global share markets have also recovered almost all losses since October 7.

So, what did the ‘worst’ geopolitical event look like? World War 2 makes for an interesting case study. In the initial years of the War between 1939 and 1941, the US stock market fell around 40% due to the war’s potential economic impact and uncertainty around the duration and likely outcome. However, the market rapidly recovered as the economy shifted to support the war effort and by the end of the 6-year bloody conflict that cost 75 million lives, markets were up over 50% from pre-war levels. The post-WW2 era in global stock markets was characterised by a prolonged period of economic prosperity and expansion.

What happens when you fail at market timing

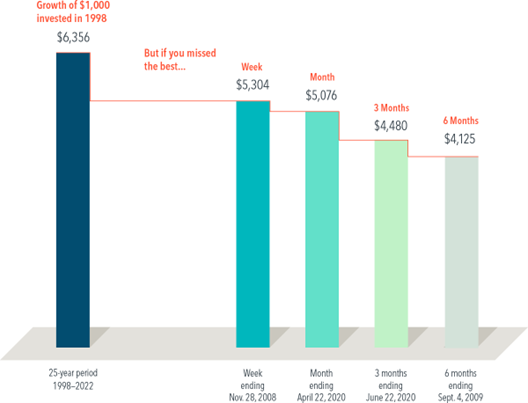

Even if you were thinking of sitting out this current turmoil, the impact of being out of the market for just a short period of time can be profound, as shown by this hypothetical investment in the stocks that make up the Russell 3000 Index, a broad US stock market benchmark.

A $1,000 investment made in 1998 turns into $6,356 for the 25-year period ending December 31, 2022. Over that same period, if you miss the Russell 3000’s best week which ended November 28, 2008, during the throes of the Global Financial Crisis (GFC), the value shrinks to $5,304. If you missed the three best months which ended June 22, 2020, in the early stages of the coronavirus pandemic, and the total return dwindles to $4,480.

Exhibit 1| Missed Opportunity Russell 3000 Index total return, 1998-2022.

Past performance, including hypothetical performance, is not a guarantee of future results.

In US dollars. For illustrative purposes. Best performance dates represent end of period (November 28, 2008, for best week; April 22, 2020, for best month; June 22, 2020, for best three months; and September 4, 2009, for best six months). The missed best consecutive days examples assume that the hypothetical portfolio fully divested its holdings at the end of the day before the missed best consecutive days, held cash for the missed best consecutive days, and reinvested the entire portfolio in the Russell 3000 Index at the end of the missed best consecutive days. Data presented in the growth of $1000 exhibit is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The data is for illustrative purposes only and is not indicative of any investment. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

There’s no proven way to time the market—whether that be targeting the best days or moving to the sidelines to avoid the worst. So, the evidence suggests staying put through good and bad times, as missing only a brief period of strong returns can drastically impact overall performance. We believe that investing for the long term helps ensure that you’re in position to capture what the market has to offer.