I recorded a podcast with Aden and Nick yesterday titled The Half Time Break, where we looked at the first half of 2025 and everything that’s happened since January. I confess I was a bit taken aback by just how much has happened in the year so far—political shocks, economic swings, and surprising market resilience.

Major headlines: January–June 2025

- Trump Inauguration: We all knew it would be an unconventional presidency but the first few weeks of DOGE cuts, and his flurry of executive orders gave insight into the President’s priorities.

- Tariff Turmoil: The US administration announced sweeping tariffs in April, sending global shares tumbling. Just a week later, the tariffs were paused for 90 days, leaving investors in suspense.

- Geopolitical Tensions: War in Ukraine and the Middle East escalated, with Israeli and American strikes on Iranian nuclear sites sparking a 10% spike in oil prices. Fears of a blockade in the Strait of Hormuz threatened global trade, though a fragile ceasefire eventually calmed markets.

- US Debt and Policy Shifts: The US passed the “One Big Beautiful Bill”, adding up to $3 trillion in new debt. Moody’s responded by downgrading America’s credit rating. The US dollar weakened as confidence wavered.

- Market Divergence: Australian equities showed a split personality. The financial sector, led by CBA, soared with CBA returning nearly 15% over six months. Meanwhile, mining lagged as China’s demand for iron ore continued to fall.

- Safe Havens and Bond Markets: Gold rallied over 40% as investors sought safety. Despite volatility, global and Australian bonds posted strong returns, helped by falling yields.

- Resilient Markets: Despite all the noise, both Australian and global equities ended the quarter at new highs. Disciplined investors, who ignored the headlines, were rewarded[1].

Life is turbulent

Turbulence isn’t an exception; it’s the rule, but as I have already said, 2025 is off to an especially turbulent start. Every week brings a new headline—tariffs, war, political brinkmanship, or market swings. It’s easy to feel overwhelmed or paralysed by the constant stream of discomforting news. Yet, markets often ignore the drama and move forward regardless.

I think about leadership a lot during turbulence. I want our clients and our team to feel safe no matter what is happening in the economy, the markets, or the world. I find the idea of always being in motion helps me enormously, so I thought I’d share it with you.

Making sense of the VUCA world

To make sense of this chaos, I lean on the VUCA framework—Volatility, Uncertainty, Complexity, Ambiguity. Originally published by Warren Bennis and Burt Nanus, they sought to describe a more complex and multilateral world at the end of the Cold War. The theory was adopted by the US Army War College, VUCA gives us a way to understand what’s happening.

- V = Volatility: Characterizes the rapid and unpredictable nature of change.

- U = Uncertainty: Denotes the unpredictability of events and issues.

- C = Complexity: Describes the intertwined forces and issues, making cause-and-effect relationships unclear.

- A = Ambiguity: Points to the unclear realities and potential misunderstandings stemming from mixed messages.

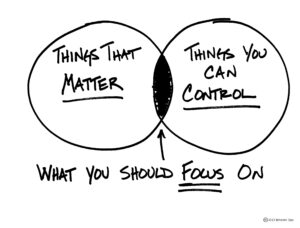

VUCA is important because it provides structure when everything feels unpredictable. It helps me, and hopefully you, to focus on what can be controlled and to prepare for a range of outcomes.

Finding confidence

Confidence is not a fixed thing; it is something you build through action and experience. I often see people displaying a lack of confidence and they are seemingly helpless to do anything about it.

The world’s leading entrepreneur coach, Dan Sullivan, has the best explanation of how the process of gaining confidence works. He describes it as his 4C’s Formula.

Gaining confidence is a four-stage process. Commitment. Courage. Capability. Confidence. Understanding the formula means that confidence is the product of the first three steps.

Dan Sullivan’s 4C Formula—Commitment, Courage, Capability, Confidence—captures this cycle:

| Step | Description | Example Scenario |

| Commitment | Set a goal despite uncertainty. | Decide to stay invested during market swings. |

| Courage | Take action without guarantees. | Sit with the discomfort of the present circumstances. Decide not to sell in a downturn. |

| Capability | Build skills and resilience through experience. | Learn to rebalance and diversify as new risks emerge. |

| Confidence | Confidence grows from progress and learning. | After a recovery, trust your process for next time. |

This cycle repeats. Every new challenge means starting again – making a commitment, acting with courage, building capability, and gaining confidence. Confidence is not permanent; it is earned, lost, and rebuilt through experience.

My example is just that. If you think back to any major new capability you have mastered in life, this will be the process you followed.

I’d encourage you to think of a time where you have made a commitment, displayed the courage to see it through, gained a new capability, and as a result, felt more confident.

I think this is an important natural law, and it will help you focus on the things that matter.

Leading self before leading others

You cannot lead others if you cannot lead yourself. Turbulence tests discipline and focus. Self-leadership is about managing your reactions, keeping perspective, and acting with intention. If I stay calm and clear-headed, I can help others do the same.

Those who master self-leadership become anchors for others, offering calm and clarity when anxiety is high. Self-leadership is also about continuous learning. The world changes quickly. Leaders who adapt, reflect, and adjust stay relevant and effective. This is not about perfection, but about resilience and deliberate action.

The case for rational optimism

Rational optimism is the choice to acknowledge risks without being paralysed by them. It is not blind faith or wishful thinking. Instead, it is a disciplined approach to uncertainty—recognising challenges, preparing for setbacks, and moving forward anyway.

The past six months have shown that markets can recover from shocks, and that disciplined investors are often rewarded. The remainder of President Trump’s presidency will almost certainly be a roller coaster and I am determined to engage with the newsfeed on my terms. By focusing on what I can control, and what makes me and my family happy.

Rational optimism means focusing on long-term goals. Many people have heard me say, “every successful client we have (and that’s all of them), is acting on a plan.”

This mindset is essential in a VUCA world. Optimists are in motion—they adapt, learn, and progress. Pessimists, paralysed by fear and anxiety, miss opportunities (and life).

Rational optimism keeps you moving, even when the path is unclear.

Final thoughts

The first half of 2025 has been a masterclass in turbulence. The VUCA framework helps make sense of it, and the 4C Formula shows how to build confidence and keep moving. By leading myself first and choosing rational optimism, I put myself in the best position to thrive—no matter the headlines.