The RBA’s next interest rate decision meeting will be Melbourne Cup Day on Tuesday 4th November. There will be plenty of bets placed on favourites, non-favourites, and every other one of the 24 horses that take part in the iconic race. But here is one bet you shouldn’t even think about – that the RBA will lower interest rates by 25bps.

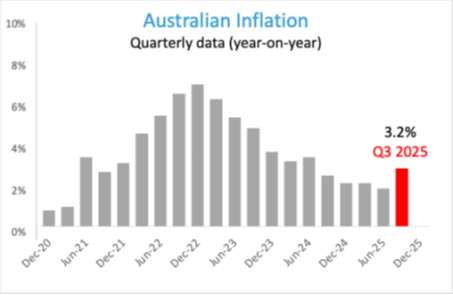

Data just released shows underlying inflation rose for the first time in almost three years to 3 per cent – the top of the Reserve Bank’s target band. The result, well above the 2.7 per cent underlying price rise market economists were expecting, dashes hope of an interest rate cut on Cup Day but also slashes the prospect of a rate cut in December.

The trimmed mean – the RBA’s preferred measure of inflation that strips out the most volatile price movements – rose 1 per cent in the September quarter, according to the Australian Bureau of Statistics.

Electricity prices jumped a sharp 9 per cent in the quarter, following the expiration of government energy bill rebate payments in Queensland, Western Australia and Tasmania. Housing (+2.5 per cent), recreation and culture (+1.9 per cent) and transport (+1.2 per cent) also recorded large quarterly increases in prices.

The bond market immediately reacted with a spike in short term yields, reflecting that bond traders have now abandoned all hopes of an interest rate cut by the Reserve Bank of Australia until at least mid-2026,

Currency markets also reacted with the Australian dollar jumping to a three-week high of US66.07¢, while the share market tumbled the most in two months, sending some of the country’s biggest property stocks including Mirvac tumbling more than 2 per cent.

Economists are now stating that here’s absolutely no chance of a rate cut at the November Cup Day board meeting and no chance of a cut at the December meeting. The central bank could even be done and dusted this cycle. Have fun if you are betting on Melbourne Cup Day, but don’t bet on a rate cut from the RBA.

Dr Steve Garth

30 October 2025

Dr Steve Garth PhD, M.App.Fin., BSc., BA. is the Principal of Principia Investment Consultants and works with Capital Partners assisting with communications.

For nearly two decades, Steve played a key role in helping grow the Australian arm of a global asset manager. During his career, he managed Australian and global equity portfolios, managed the Asia Pacific trading team and for the last 10 years he managed the firm’s fixed interest strategies.

Steve received his PhD in Applied Mathematics from the Australian National University. He also holds a BSc in Mathematics and Physics, a BA with majors in History and Politics, a Master of Applied Finance.