Research, Trends, Topics and Asset Class Returns for Long-term Investors. The impact of Brexit.

The ‘shock’ decision in June 2016 of the Brits to leave the European Union was a reminder that financial markets prefer certainty, and will react, sometimes violently, to shocks. In the following week the London market fell 7.18 per cent, the German DAX 6.62 per cent, and way down under in Australia, our market was down 3.09 percent.

That text was what I wrote just after the Brexit vote and now we are on the eve of the actual Brexit event occurring. It’s hard to conceive of a more shambolic process and the uncertainty is really beginning to take hold in the UK. We are all wondering what the impact of Brexit will look like.

We are a long way away from Old Blighty, yet the ramifications of a no-deal Brexit will send ripples around the world’s financial markets and beyond. This is the kind of uncertainty financial markets hate, so rather than hide from it I thought it best to have the conversation.

The problem with speculating on Brexit is that is really is a monumental mess. The EU is resolutely refusing any soft compromise lest any other EU member state be tempted to head for the exit, while the British public and parliament is as divided as they were the day the vote was taken.

So, what on earth does an investor do in the face of potentially one of the biggest upheavals the Europe has faced in years? Without a crystal ball it is hard to tell, so I thought I’d share an interpretation of the situation from the chief economist of Vanguard Europe, Peter Westaway.

“No Deal would be the “hardest” type of Brexit on offer, involving the UK moving on to World Trade Organisation trading arrangements with higher tariffs and more restrictive movements on goods across borders, as well as the lapsing of other UK-EU arrangements.

We believe it is more likely that some kind of deal with the EU will be reached, probably involving a type of free trade arrangement with minimal tariffs on trade in goods with the EU but no harmonisation of standards as occurs in the European Single Market. This would probably be costly for the UK economy and still constitute a moderately “hard” Brexit. Less costly would be some variant of a so-called “soft” Brexit.

The reality is, however, that no political consensus has been reached within the UK nor between the UK and EU on what rules should apply. One particular stumbling block has proved to be the treatment of the border between Northern Ireland and the Republic of Ireland, which post-Brexit will form a land border between the UK and the EU. Indeed, the inability to reach agreement has increased the possibility that the 29 March deadline will be extended and even that a new referendum might be called which could potentially reverse the original decision and lead to the UK staying in the EU after all.

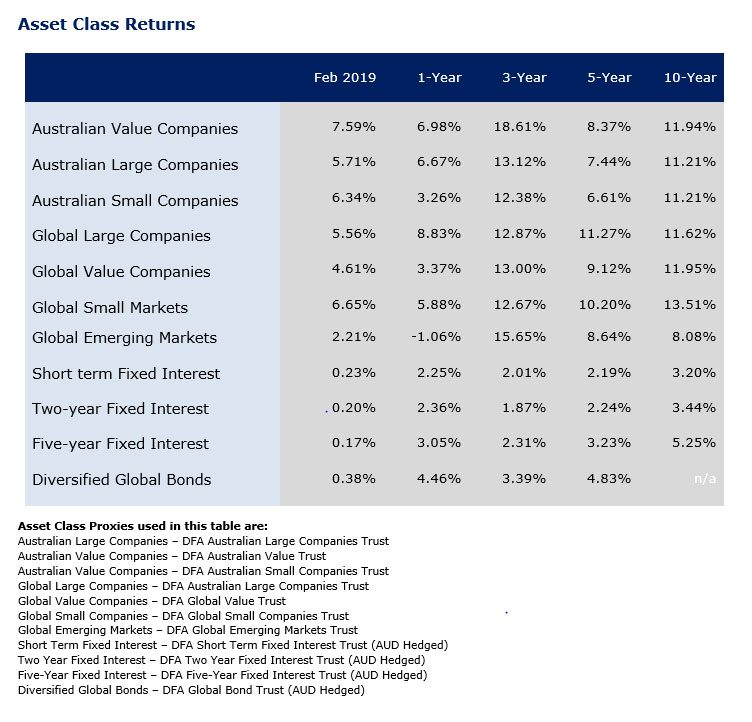

So how should investors respond to this Brexit uncertainty? The only way is to accept that the uncertainty will result is short-term volatility and considerable emotional discomfort. In the absence of a crystal ball, the case for a well-balanced globally diversified portfolio of stocks and bonds is as strong today as ever.