The emergence of DeepSeek, a Chinese Artificial Intelligence (AI) startup, has challenged the U.S. AI industry’s dominance. This has raised concerns about the sustainability of AI-driven market valuations, particularly impacting Nvidia. While broader economic concerns and U.S. policy shifts have compounded the downturn in Nvidia’s share price, the correction may also be a sign of deeper shifts in AI valuations. Are AI stocks losing air?

The myth of permanent market leaders

One of the most repeated mistakes equities investors make is the assumption that an industry leader will always remain so. Nobody ever seems to assume that competitors will emerge and take a significant share from the first mover. That failure often leads to unrealistic pricing.

The recent emergence of DeepSeek, a small but innovative Chinese artificial intelligence (AI) startup, has just shaken the U.S. AI leadership narrative. DeepSeek’s revolutionary reasoning model is reported to have stunned the industry with its comparatively excellent performance over leading American AI models.

If the Chinese demonstration is to be taken at face value, the development raises serious questions about the sustainability of the U.S.-dominated AI boom, particularly for companies like Nvidia, whose fortunes are deeply intertwined with the sector’s growth.

Market sensitivity to narrative shifts

Whenever financial market performance and valuations hinge on a handful of high-performing stocks, even a minor disturbance to the narrative can lead to dramatic consequences. When DeepSeek was released in early February Nvidia saw its valuation plummet by nearly 17%. Such volatility is seen as good reason to reassess the assumptions about the AI market’s future.

DeepSeek’s model has drawn attention not just for its performance but for its cost-effectiveness. Unlike U.S.-based companies that have poured billions into building proprietary AI models, DeepSeek reportedly achieved groundbreaking results with a much smaller investment. Moreover, the startup’s decision to release its model as an open-source platform threatens to democratize AI in a way that could destabilise the current market dynamics upon which the current lofty valuations are based.

Repricing the AI narrative

The U.S. stock market gains over the last few years have been concentrated in a handful of tech companies. Any reappraisal of their prospects can trigger sharp downturns, as seen in Nvidia’s sell-off over growth concerns. Some analysts argue that the market may simply be adjusting to more rational valuations after a period of exuberance. Others, however, warn that this could mark the beginning of a more significant shift in the AI industry’s trajectory.

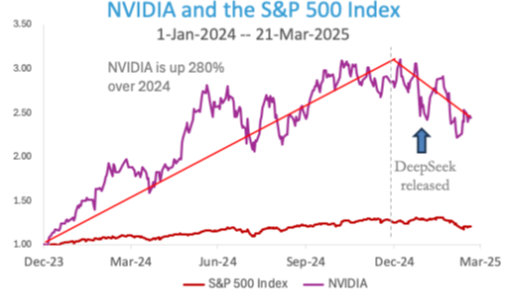

The chart below shows the impact of DeepSeek on Nvidia’s share price back in early February, but also tracks the decline in the share price since its peak at the start of the year. The continuing decline in the Nvidia share price and the overall market has been impacted by the aggressive economic policies of the new US Administration, but the fact that that AI stocks are falling harder and faster than other stocks does indicate that there is a re-evaluation of the benefits of AI taking place.

From hype to reality: Reassessing AI valuations

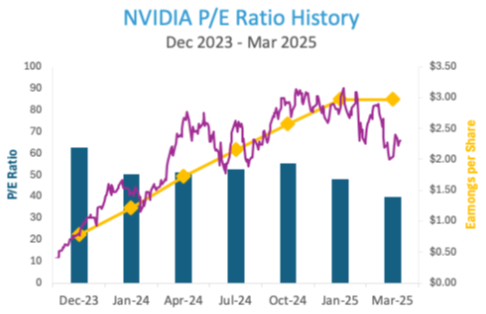

Nvidia and other AI stocks aren’t necessarily in a ‘bubble’ where prices exceed valuation models. Some commentators warn about high share prices for Nvidia, Apple, and Microsoft. They also raise concerns about broader U.S. stock overvaluation. However, these price increases have been matched by rising earnings.

The chart shows Nvidia’s EPS rising in line with its share price. A lower price has reduced the P/E ratio, which helps define whether a stock is considered ‘growth’ or ‘value’. Value stocks have low P/E ratios, while growth sticks have high P/E ratios.

Rather than calling Nvidia and other AI stocks a ‘bubble,’ it’s more apt to say investor enthusiasm is fading. In other words, it does seem as if the air is coming out of the AI balloon.

Predicting winners in technology is impossible. One bad month or quarter doesn’t end the AI boom—but it exposes the risks of a concentrated market.

As the AI landscape continues to evolve, it’s crucial to stay informed and adaptable. What are your thoughts on the emergence of DeepSeek and its impact on the AI industry? Let’s discuss. For more market insights and assistance managing your financial landscape, contact us today.

Dr Steve Garth

March 21st, 2025

Dr Steve Garth PhD, M.App.Fin., BSc., BA. is the Principal of Principia Investment Consultants and works with Capital Partners assisting with communications.

For nearly two decades, Steve played a key role in helping grow the Australian arm of a global asset manager. During his career, he managed Australian and global equity portfolios, managed the Asia Pacific trading team and for the last 10 years he managed the firm’s fixed interest strategies.

Steve received his PhD in Applied Mathematics from the Australian National University. He also holds a BSc in Mathematics and Physics, a BA with majors in History and Politics, a Master of Applied Finance.