Have you considered how markets have changed in the last 25 years?

How they have moved through some of the world’s largest events. Whether the internet, smart phones and data have changed them.

It’s been a prosperous time to be an investor, and if you had invested $100,000 into global equity markets at the inception of Capital Partners, that investment would now be worth close to half a million dollars.

A lot has happened to markets in the last 25 years, but the fundamental principles are unchanged.

What has happened

Over the last two and a half decades we have had four major market corrections of 20% or more. This includes the tech wreck of 2000, the GFC in 2009, COVID-19 and inflation fears through 2022.

Still, global economies grew and markets hit record highs over 300 times—despite media predictions of crashes.

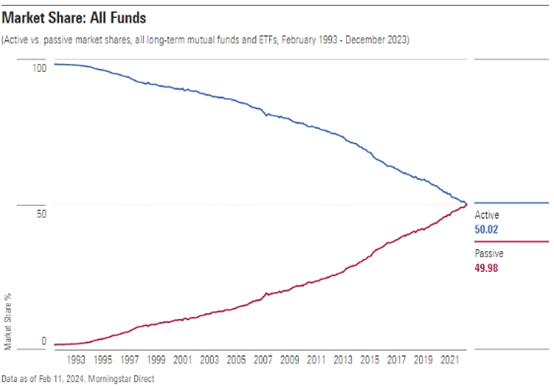

The internet took over the world, and with increasing computing power the two brought about the rise of the index fund. The index fund now accounts for about 30% of the Australian and US equity markets and is the largest single strategy in the world. Currently there is roughly $14 trillion invested in index funds between the US and Australia. The chart below highlights the consistent transfer of funds away from active investment towards passive over time.

Our values now impact how we invest

The rise of Environmental, Social and Governance (ESG) investing means we see greater demand for sustainability from the companies we’re investing in. How businesses generate their returns matters more than ever before and investors will punish those who turn a blind eye. For the first time investors can align their values with their investment philosophy and still generate consistent, reliable investment outcomes.

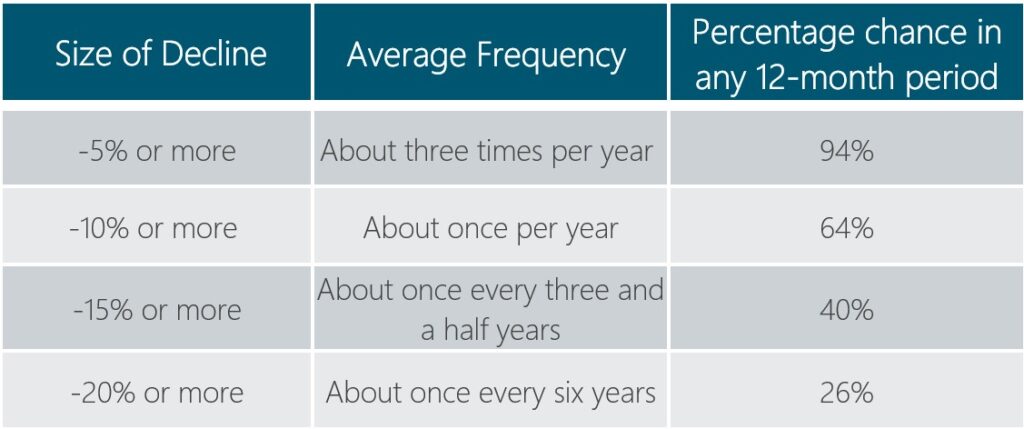

Continual advancements of technology now mean investors have the ability to trade anywhere in the world at the click of a button. This, combined with algorithmic trading systems, increased participation by retail investors and ever-growing media coverage, from both PHDs and “finfluencers” (think Gamestop), has resulted in increased market volatility.

The chart below shows how regularly we expect a 5%, 10%, 15% and 20% plus decline:

Interest rates in Australia were around 5% in 1999 and rose to 7% before the GFC. They dropped to nearly 0% in 2019 and have since climbed above 4% following one of the most aggressive rate hikes in history.

Around the year 2000, Capital Partners began developing an evidence-based investment strategy inspired by Nobel Prize-winning research. This research showed that smaller, value-oriented, and more profitable companies tend to outperform over time.

Soon after, Dimensional Fund Advisors entered the Australian market, allowing us to apply this research practically. We built portfolios that combined the diversification of index funds with the potential for higher returns.

What have we learned

A systematic investment approach is critical: In the words of the late Charlie Munger, ‘you don’t need a stratospheric IQ to make investment decisions, you just need a process that works.’ Our thinking has evolved to reflect this mantra.

Early on, we invested with a highly regarded active fund manager known for outsmarting the market. You can imagine our disappointment when after 12 months the key manager left causing us to rethink our recommendations.

From that point onwards, we decided to never recommend an approach that relied on the skill of any one person. We’ve set clear portfolio rules so every client gets the same investment experience, regardless of their adviser. It’s robust, reliable and repeatable.

Your goals are the most important benchmark: You cannot truly build an appropriate portfolio for someone if you don’t first know what it is for. The right investment approach depends on your goal. Saving for a home deposit is very different from investing for retirement at age 30.

Most people don’t stop spending when the ASX drops 10%. That’s why building a portfolio that can handle market volatility is just as important as capturing gains during strong markets.

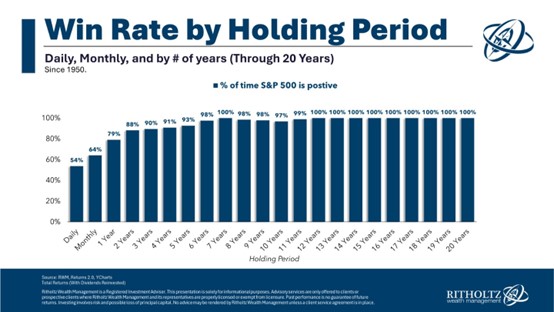

Managing your emotions and staying the course is the real price of equity market returns: when looking at equity markets over the last 25 years, they go up by more than they go down, and more than a test of intelligence they are a test of patience. The chart below shows that the US equity market has generated a positive return 93% of the time in any given five-year period since 1950. Over ten years markets have gone up 97% of the time, and there is no fifteen-year period where the US equity market has gone backwards.

Despite this, we often get asked: is now the right time to buy? or should we go to cash and buy back in when things have calmed down?

People crave certainty. However, to get the rewards of long-term share market returns you need to tolerate the uncertainty of markets going down. During these times, media coverage often intensifies with headlines like “this time is different” or “more pain to come.” However, investors that have a strategy that’s plans for this volatility, will reap the rewards.

Despite all the changes in the world over the past 25 years, the core principles of investing remain strong. By following a systematic strategy and tuning out media noise, investors are well-positioned to benefit from the next 25 years.